Is It Insider Trading if You Know Someone Is Going to Downgrade Reddit

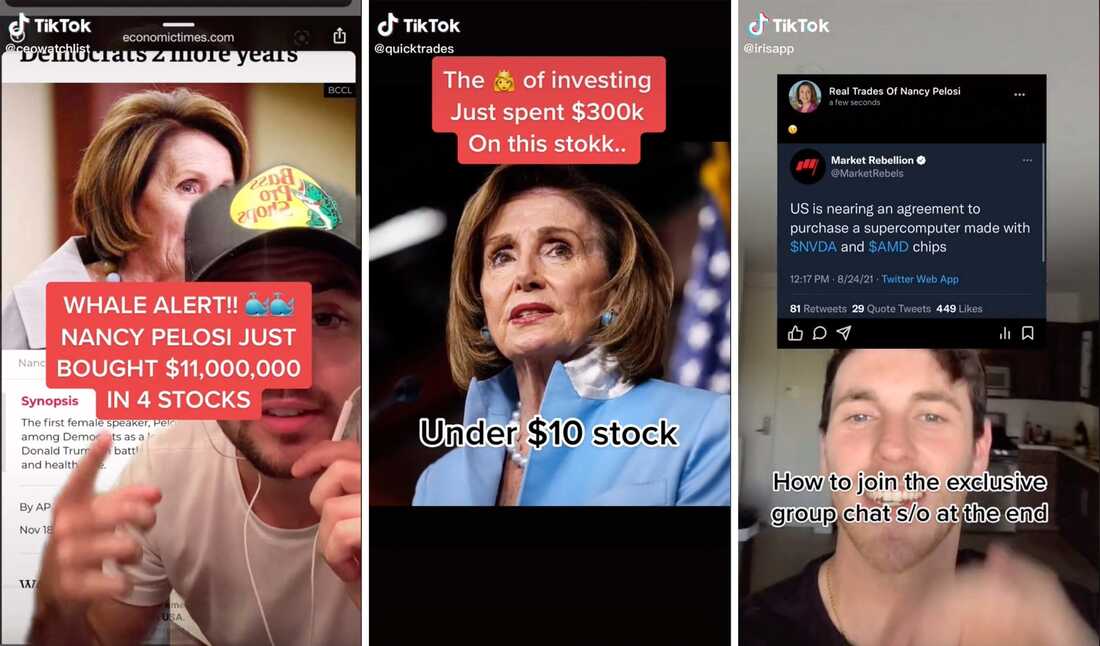

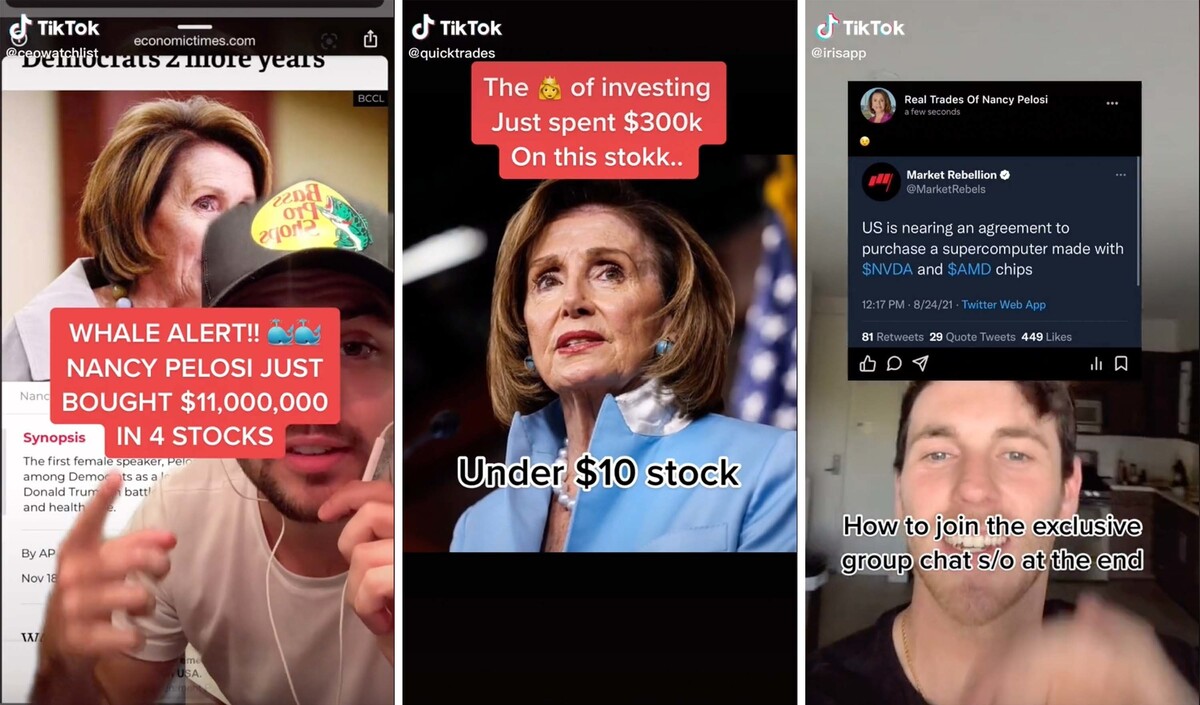

A community of young investors on TikTok, including @ceowatchlist, @quicktrades and @irisapp, are using Business firm Speaker Nancy Pelosi's stock trading disclosures as inspiration for where to invest themselves. One user called Pelosi the market's "biggest whale," while another called her the "queen of investing." @ceowatchlist; @quicktrades; @irisapp/TikTok hibernate explanation

toggle caption

@ceowatchlist; @quicktrades; @irisapp/TikTok

A community of young investors on TikTok, including @ceowatchlist, @quicktrades and @irisapp, are using House Speaker Nancy Pelosi's stock trading disclosures as inspiration for where to invest themselves. One user called Pelosi the market place's "biggest whale," while some other called her the "queen of investing."

@ceowatchlist; @quicktrades; @irisapp/TikTok

Immature investors accept a new strategy: watching financial disclosures of sitting members of Congress for stock tips.

Among a certain community of private investors on TikTok, House Speaker Nancy Pelosi's stock trading disclosures are a treasure trove. "Shouts out to Nancy Pelosi, the stock marketplace'south biggest whale," said user 'ceowatchlist.' Another said, "I've come to the decision that Nancy Pelosi is a psychic," while calculation that she is the "queen of investing."

"She knew," alleged Chris Josephs, analyzing a particular merchandise in Pelosi's financial disclosures. "And you would have known if yous had followed her portfolio."

Last yr, Josephs noticed that the trades, really made by Pelosi's investor husband and only disclosed by the speaker, were performing well.

Josephs is the co-founder of a company called Iris, which shows other people's stock trades. In the by yr and a half, he has been taking advantage of a police force called the Stock Act, which requires lawmakers to disclose stock trades and those of their spouses within 45 days.

Now on Josephs' social investing platform, you can get a button notification every time Pelosi'due south stock trading disclosures are released. He is personally investing when he sees which stocks are picked: "I'm at the point where if y'all tin can't crush them, join them," Josephs told NPR, adding that if he sees trades on her disclosures, "I typically practice buy... the next i she does, I'one thousand going to buy."

A Pelosi spokesperson said that she does not personally ain any stocks and that the transactions are made by her husband. "The Speaker has no prior knowledge or subsequent involvement in whatsoever transactions," said the spokesperson.

Still Josephs views trades by federal lawmakers as "smart money" worth following and plans to track a large variety of politicians. "We don't desire this to ... be a left vs. right thing. Nosotros don't really care. We just want to make coin," he said.

Pelosi is inappreciably the merely lawmaker making these stock disclosures. So far this year, Senate and Business firm members accept filed more than than 4,000 financial trading disclosures — with at least $315 million of stocks and bonds bought or sold. That's according to Tim Carambat, who in 2020 created and at present maintains ii public databases of lawmaker financial transactions — House Stock Watcher and Senate Stock Watcher. He says in that location is a significant following for his work.

"I knocked out a very, very elementary version of the project in similar a couple of hours. And I posted it actually to Reddit, where it gained some significant traction and people showed a lot of involvement in it," Carambat said.

Dinesh Hasija, an assistant professor of strategic management at Augusta University in Georgia, has been studying whether the market place moves based on congressional disclosures. His ongoing enquiry suggests that it does.

"Investors perceive that senators may have insider information," he said. "And we see abnormal positive returns when there's a disclosure past a senator."

In other words, Hasija's research shows that after the disclosures are published, there's a bump in the price of stocks bought past lawmakers.

At least i financial services consultant, Matthew Zwijacz, is planning to gear up a financial instrument that automatically tracks congressional stock picks, considering, in his view, lawmakers are "probably privy to more information than just the general public."

Both investors and government watchdogs are interested in these trades because of the possibility that lawmakers could apply the private information they obtain through their jobs for money-making investment decisions.

"If the situation is that the public has lost so much trust in government that they think ... the stock trades of members are based on corruption, and that [following that] corruption could benefit [them]. ... We accept a pregnant problem," said Kedric Payne, senior director of ethics at the Entrada Legal Heart.

A surge of interest post-obit congressional financial disclosures came near the first of the COVID-19 pandemic, when a flurry of reports indicated that lawmakers sold their stocks right before the financial crash.

NPR reported how Senate Intelligence Committee Chairman Richard Burr privately warned a small group of well-connected constituents in February 2020 about the dire furnishings of the coming pandemic. He sold up to $one.72 1000000 worth of personal stocks on a single twenty-four hours that aforementioned calendar month.

A bipartisan group of senators also came nether suspicion, including Sens. Dianne Feinstein, James Inhofe and Kelly Loeffler. Afterward investigations past federal law enforcement, none were charged with insider trading — a very difficult charge to make against a sitting lawmaker.

Congressman Raja Krishnamoorthi, a Democrat from Illinois, is part of a bipartisan group of House and Senate members who have introduced legislation banning lawmakers from owning private stocks. He has run upwards confronting a lot of opposition to the idea.

"As I understand it, one of the perks of beingness a member of Congress, especially from the tardily 1800s on, was to be able to trade on insider data. That was a perk of beingness in Congress. And that has got to come to an finish," Krishnamoorthi said.

Polling shows that at that place is wide support for enacting this prohibition. Co-ordinate to a survey done this year by Data for Progress, 67% of Americans believe federal lawmakers should not own individual stocks.

There's a deep pessimism that forms the foundation of a trading strategy based on mimicking the stock picks of lawmakers and their spouses: the notion that politicians are decadent and that you can't trust them not to engage in insider trading — so if the information is public, you might too merchandise what they're trading.

But despite all the skepticism about politicians and their ethical standards, the bear witness doesn't show that members of Congress make great stock pickers. While a 2004 newspaper found that senators generally outperformed the market, more than recent academic studies in 2013 and over the final few years take suggested lawmakers are non proficient at picking stocks.

"Those papers have institute that in fact, the trades fabricated by senators have underperformed," Hasija said.

This means if you e'er take a stock tip from a lawmaker — pessimism bated — it might not exist a very good trade.

Source: https://www.npr.org/2021/09/21/1039313011/tiktokers-are-trading-stocks-by-watching-what-members-of-congress-do

0 Response to "Is It Insider Trading if You Know Someone Is Going to Downgrade Reddit"

Post a Comment